method

DATA SCIENCE

method

DATA SCIENCE

Exit-Grade IP & Defensibility Assessment

Stress-testing the assumptions behind valuation, defensibility, and exit outcomes

method

DATA SCIENCE

method

DATA SCIENCE

Stress-testing the assumptions behind valuation, defensibility, and exit outcomes

The Question You Need to Answer

If an acquirer's diligence team spent 30 days stress-testing your defensibility narrative, what would they find?

Would your valuation assumptions hold — or would you be negotiating concessions?

Most investors don't know. Most portfolio companies can't say with confidence. And by the time the question gets asked in a live process, it's too late to change the answer.

Most technology companies are valued as if their defensibility, IP posture, and technical differentiation are proven.

In reality, those assumptions are rarely stress-tested.

The Problem

Traditional diligence focuses on financials, legal ownership, and operational metrics. It often misses whether product, technology, and IP strategy actually support the valuation story — until late-stage diligence, integration, or exit.

That gap creates:

The pattern is consistent: defensibility assumptions go untested until an external event forces scrutiny. By then, remediation is reactive, leverage shifts to the other side, and value quietly erodes.

What This Assessment Does

The Exit-Grade IP & Defensibility Assessment evaluates whether the assumptions embedded in valuation and exit narratives are supported by evidence across product, technology, and IP posture.

In 21 days, we identify:

This is not legal diligence. It is not implementation. It is a valuation-aligned stress test designed for capital allocators and boards — delivered before buyers or follow-on investors ask the hard questions.

Audience

Timing

This assessment is typically engaged:

The common thread: these are moments when assumptions become consequential.

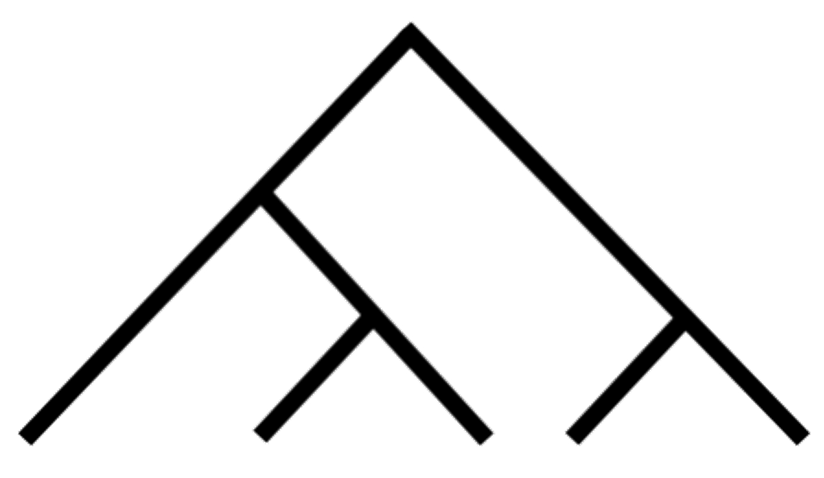

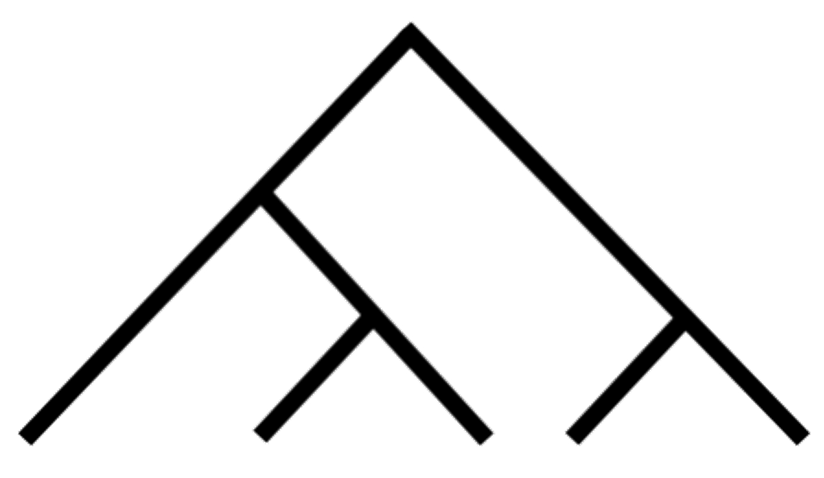

Methodology

We identify the core assumptions underlying defensibility, differentiation, and exit narratives — and test whether they are supported by product, technology, and IP reality.

We map where value is being created across systems, workflows, data, and product evolution — and where that value is not being captured, protected, or reinforced.

We model how defensibility evolves over time if nothing changes — and how targeted IP and product alignment could materially alter that trajectory.

This analysis is directional, not prescriptive. The goal is to show where the company is headed and what levers exist to change course.

Deliverables

All findings are framed in valuation language for board and investor consumption:

No legal opinions. No implementation. No scope creep. Deliverables are designed to travel forward — usable in future diligence, shareable with acquirers, and referenceable in board discussions.

Differentiation

Law firms protect what is already known. This assessment reveals what is assumed — but not yet proven.

Engagement

*Timeline assumes timely access to requested materials and stakeholders. Delays extend delivery proportionally.

Before We Begin

A brief pre-engagement intake (30–45 minutes) covering:

If scope exceeds a single assessment, this is flagged before engagement.

The Outcome

Clients use this assessment to reduce diligence risk, strengthen defensibility narratives, align product and IP strategy, and protect valuation before scrutiny begins.

Method Data Science | Newport Beach, CA

Sample Artifact

Redacted example — structure and depth representative, content anonymized. This illustrates how valuation assumptions are stress-tested against product, technology, and IP evidence.

To make explicit which defensibility assumptions embedded in valuation are doing the most work — and whether they are supported by evidence, dependent on undocumented knowledge, or exposed to replication and erosion risk.

| Assumption | Where It Appears | Why It Matters |

|---|---|---|

| Product differentiation is difficult to replicate | Management deck, CIM | Justifies revenue multiple premium |

| Data advantage compounds over time | Exit narrative | Supports long-term defensibility claims |

| Customer switching costs are high | Board materials | Assumes pricing power and retention |

| Technical know-how is institutionalized | Diligence Q&A | Reduces key-person risk |

| IP posture supports exclusivity | Legal diligence | Limits competitive entry |

| Assumption | Evidence Status | Notes |

|---|---|---|

| Product differentiation | Partially supported | Core workflow is differentiated; adjacent features are replicable |

| Data advantage | Fragile | Data aggregation exists but lacks formal protection or exclusivity |

| Switching costs | Assumed, not proven | No contractual lock-in; switching cost is operational, not structural |

| Institutionalized know-how | High risk | Critical logic resides with 1–2 individuals |

| IP posture | Incomplete | Multiple latent IP assets unrecognized and undocumented |

| Assumption | Risk Level | Primary Risk Driver |

|---|---|---|

| Product differentiation | Medium | Competitors could copy non-core workflows |

| Data advantage | High | No trade secret controls; no contractual data exclusivity |

| Switching costs | Medium | Switching friction declines as market matures |

| Institutional knowledge | High | Key-person dependency |

| IP posture | Medium–High | Value created but not captured |

Key insight: The valuation narrative assumes defensibility is structural. In reality, it is currently behavioral and organizational. This does not imply the valuation is wrong. It implies the valuation is conditional.

Clients use this map to: